Contents:

I now feel that I am in control and that is a great feeling. I never am afraid to ask Dave a question; he has patience and is proactive in wanting me to understand my business; that has been a gift to me. Phoenix Bookkeeping Specialists has been working with me and my company for about two years and has proven to be one of the most valuable assets we have.

In this course, students examine managerial accounting as part of the business’s accounting information system as well as legal aspects of the business enterprise. Most bookkeepers on the market have no specialized education or training. Choosing bookkeeping services directly through an established CPA firm is the best way to go for quality and peace of mind as well as the option to have additional support. I was hesitant to hire a bookkeeper, though I needed one with my growing business. Dave has proven to be a great investment in my business because his professional services allow me to focus on the bigger picture.

Local Bookkeeping Services In USA

They also https://1investing.in/ free consultations and discounts for first-time tax clients. Mom and Pop Tax Shop has been in the business since 2007. MLR Professional Tax Services is a tax and accounting service provider located in Goodyear, Arizona that provides assistance and support to corporations, individuals, tax and accounting professionals. The company offers individual and corporate tax services, bookkeeping, and professional tax services. They also provide CE classes for tax preparers to meet the mandated requirement of the IRS.

Weech Financial, PLLC is an experienced financial services firm located in Mesa, Arizona that is managed by a licensed CPA. The company prides itself on providing solutions and strategies that produce tax savings and efficiencies. The company offers accounting services, tax preparation, business accounting, and business consulting. Mark Weech, the owner of Weech Financial, PLLC, has more than 20 years of experience in public accounting and established the company in 2007. Sapphire Bookkeeping and Accounting in Glendale, Arizona provides affordable services for individuals and small businesses. They offer tax preparation, general bookkeeping, new business formation, payroll services, tax planning, financial planning, sales tax services, and financial statement preparation.

ACCOUNTING IS THE LANGUAGE OF THE PRACTICAL BUSINESS LIFE

With direct integrations with the most innovative payroll companies in the country. We’ll make your payroll process easier and more streamlined. Phoenix Bookkeeping Specialists common email format is , being used 100% of the time. Course Sequence total credits may differ from the program information located on the MCCCD curriculum website due to program and system design.

Other topics include the professional responsibilities of CPAs, deferred taxes, cash flow statements, balance sheet preparation, restructuring of troubled debt, and the intricacies of comprehensive income. We answer start-up questions, provide routine accounting, consult on performance, handle sales tax returns, and prepare financial reports. In short, we handle tasks, support managers, and keep financial information timely.

- This company offers accounting services, business consultation and planning, tax preparation, and payroll services.

- It provides a variety of services that include bookkeeping, bank reconciliation, and QB payroll processing.

- There are multiple options available for this pathway map.

- Mark Weech, the owner of Weech Financial, PLLC, has more than 20 years of experience in public accounting and established the company in 2007.

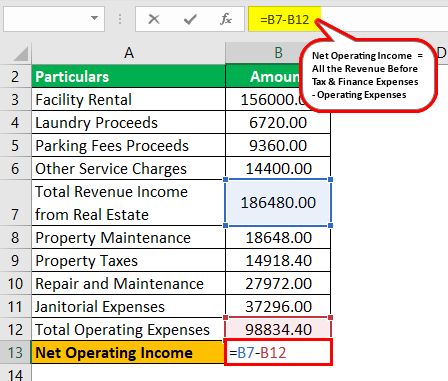

For a list of trusted third parties that we use to process your personal information, please see our third party vendors below. GAAP readiness is important for many businesses, especially those who are undergoing an internal audit or being subjected to an IRS audit. Compute, classify, and record numerical data to keep financial records complete. Perform any combination of routine calculating, posting, and verifying duties to obtain primary financial data for use in maintaining accounting records. May also check the accuracy of figures, calculations, and postings pertaining to business transactions recorded by other workers.

Phoenix Bookkeeping Specialists

Our process is all about you and your business, so we don’t take a cookie cutter approach. Instead, we start with a conversation, speaking to you one-on-one on to make sure we know which tasks you want us to work on. Some of our clients ask us to assume all of their bookkeeping responsibilities, while others just need help with a few of the more complex and time-consuming tasks. As a business owner, you have to wear a lot of different hats, and some of them fit better than others. Many entrepreneurs find themselves struggling with their bookkeeping responsibilities.

Business owners aren’t usually included in the conversation because they’re presumably busy working. We also don’t force you on to a proprietary platform, we work in the tried and true software you already use and make it work better for you. We aren’t interested in stealing your data or holding it hostage.

Accreditation & Faculty

A balance sheet is a total asset, liabilities, and net worth computation report that helps you understand your market position and make necessary decisions. Our team of experts has an in-depth understanding of performance metrics and industry best practices that you may use to advance your organization. Wide range of Customized Bookkeeping Services for business of all size & all types provide a solid base for Financial Report and Tax Compliance. Create database for your clients, vendors, employees, and others.

Students must earn a grade of C or better for all courses required within the program. There are multiple options available for this pathway map. These options vary depending on the locations, partners, and available tracks of the award. Apply functions of modern business, including business principles, marketing, labor relations, and risk to business situations. Students must earn a grade of C or better in all courses in the program.

They’ll help assess your needs and make sure we set you up with the right amortization definition. This is why we do what we do, and can provide your Phoenix Business with an experience like no other. Email bounce rate for Phoenix Bookkeeping Specialists email addresses can be reduced using NeverBounce. NeverBounce has special logic that produces accurate results. The most used employees email address of Phoenix Bookkeeping Specialists is , being used 100% of the time.

We’ll teach your company how to accurately keep records. If you are experiencing difficulty with any content on kiser.tax or require assistance with any part of our site, please contact us during normal business hours as detailed below and we will be happy to assist. We strive to provide great Services, but there are certain things that we can’t guarantee. Click one of the buttons below to set up a meeting with a small business pro.

To the extent we process your personal data for other purposes, we ask for your consent in advance or require that our partners obtain such consent. We collect information related to how you use the Services, including actions you take in your account . We use this information to improve our Services, develop new services and features, and protect our users. Our mission is to create a web based experience that makes it easier for us to work together.

Jewish Tuition Organization executive retires The Daily … – Daily Independent

Jewish Tuition Organization executive retires The Daily ….

Posted: Mon, 06 Feb 2023 08:00:00 GMT [source]

Our integrated approach to partner with your business allows you to make strategic decisions based on real-time comprehensive financial information presented in an easy-to-understand format. You’ll have a small team with a bookkeeper and a small business advisor. You’ll have their direct line so you can reach out for support whenever you need to. We will keep your records up-to-date, so when tax season rolls around, you’ll have the financials you need to file your returns on time. If you’re looking to raise money or get credit, you’ll be ready for that too.

- It also handles payroll management for up to 10 employees with detailed reports.

- While outside career advising can cost over $200 an hour, at University of Phoenix it’s built right into your degree at no added cost.

- Let them handle your payroll, post payments from your clients, and manage your bills so you can focus on your practice or any accounting for healthcare services.

- I represent a growing nonprofit organization in California, USA and we got a lot of bang for our buck.

Students with eligible credits and relevant experience on average saved $11k and 1 year off their undergraduate degree with University of Phoenix. She is a true professional but more than that she really tries to help you get your business organized and on track to be successful. In the time I have been using Cindy with Bookkeeping Done Right I have been very pleased with her! She is very efficient & does her job well & is always available to respond to any questions I have in a timely manner. I definitely recommend her for any bookkeeping needs you have. Accounting & Taxes Get a better understanding of state and federal taxes, as well as some common tax forms.

Bookkeeping is one of those time-consuming tasks you likely don’t have time to tackle during normal business hours. Many small business owners try to wade through the invoices, income statements, vendor contracts and receipts necessary to stay on top of bookkeeping during their off hours. Ready to learn how you can strengthen your business with bookkeeping, accounting and controller services? Schedule yourFREE Consultation with Supporting Strategies | Phoenix today. Examine, analyze, and interpret accounting records to prepare financial statements, give advice, or audit and evaluate statements prepared by others.